Chapter 5

Language, Tone of Voice and Behavioural Economics

Creating a pensions ‘logo’ may be tempting as it will potentially pull the communications together, but it could also run into opposition, remember a logo is not a brand. A considered application of visual assets such as imagery, iconography, typography, graphical elements and colour, used in conjunction with words, will be successful.

Pensions in the UK have seen real innovation in recent years. It’s time the way we talk about pensions caught up.

Strong messaging is vital, but we all need to make pensions more accessible to everyone and the first step has to be changing the language we use. We know it’s complicated and full of jargon so when we start using new tools and technologies we must make sure we don’t carry forward lazy language from the past. We have to actively remove complicated and technical words which cloud understanding and halt active decision making.

We need to listen to people, as well as talk to them, and in particular the young. Using data analytics will also be critical in helping us to harness new technologies and look to the future to create engagement in pensions, as well as shape messaging for different generations of people in work.

Money Advice Service

Language, Tone of Voice and Behavioural Economics

Tone of voice is about the character of your pension (or your company) and how it comes through in your words, both written and spoken. It’s not about what you say, but the way you say it and the impression it leaves behind.

Think about your favourite actor. Can you hear how they will say something in your head? It’s the same for companies and can be for your scheme too. Most companies have guidelines for employee communications. Your company’s tone of voice is a good place to start. Is this how you want your scheme to sound to members too? It may be too formal, or overly friendly.

We will talk more in a bit about how you can go about determining your tone of voice. Once you do, it’s important to document it, share it with colleagues and providers, and check back against it when you develop new communications. Your tone of voice can be flexible, depending on your key messages and the channels you’re using but it’s important that it stays consistent. It’s easy to lapse into cliched communication styles or use jargon that will make no sense to your customers.

To identify your tone of voice, think about the three to six traits you want to embody. For example:

Then it’s time to start writing some examples:

Your voice is Friendly, Positive, Direct and Action orientated

Joining is easy. It’s all done for you when you reach your fourth month with us. You and your employer save together and you don’t pay tax on your savings. If you want to save more you can tell us .

You will be automatically enrolled in your fourth month. The employee contribution is 5% and the employer contribution is 3%. If you want to increase your contributions you can do so at the start of the month.

Tone of voice is about using language to give your scheme or product a recognisable voice. Both these paragraphs mean the same but they don’t make you feel the same. Tone of voice isn’t the same as good writing or persuasive messaging. However, you will react differently and it may impact how you behave.

Next steps

Ask yourself the following questions:

- Does the company have a tone of voice that you need to adhere to?

- Can you be friendlier whilst being factual?

- Can you replace jargon with everyday words?

A good place to start is a page of definitions. You can then share this with colleagues and providers to help with consistency. It also helps to think about your tone of voice as a famous personality. Who do you want it to sound like. Emma Thompson, Clive Myrie? Or Professor Brian Cox?

Tone of Voice Tips

Take some time to think about the people you will be communicating to – and listen to the words they use in the conversations they have and understand why they don’t use other words. Find out what they do and don’t understand and consider how they frame their knowledge and express themselves.

Social listening tools can be really helpful. Especially if it’s an audience you’re not familiar with. Consider the demographics of your audience. You may need to be more or less formal depending on who you’re writing to. However, as you’ll likely to be communicating to a diverse population it’s best to stay clear of colloquialisms and generational or area specific language. It may be more helpful to consider people’s financial confidence levels, their wider financial situations, what actions they’ve taken in the past and if you need specific actions to be taken.

What are your key messages: How can your tone of voice support this? Do you need people to absorb a lot of information or take specific action. Are you warning them about scams or encouraging them to complete an expression of wish form. Ensure your overall tone of voice has enough flexibility to support a range of key messages.

o make sure that the messages land effectively, consider the tone of voice that will work best for your audience. Write using an active positive voice – ‘you’re in’ where appropriate.

All too often we don’t explain ourselves properly. So make sure you use enough words to build a good understanding – but use short sentences. Carefully consider what information your audience needs and what they don’t need.

Gather as much feedback during the draft stages. Ask key internal stakeholders to comment specifically on the tone of voice. Also consider feedback sessions with the end consumers. This may not be practical every time but should form part of the initial tone of voice development. You can then do tone of voice feedback spot checks for future communications.

Make use of ‘you’ and don’t write in the third person. Make sure the reader can easily understand why it’s relevant, what it means for them and what they need to do.

It shouldn’t be difficult for someone to find the information they’re looking for, so information needs to be kept clear and to the point, directing people where they need to go.

Don’t be afraid to be creative if it will help deliver the right outcome. Involve your brand champions early on and get their help to find the right approach for your audience. Clear tone of voice guidelines should set out when and when not to use imagery to support/highlight key content.

Start from the principal that a jargon buster should not be needed. Jargon are words, usually technical, that people don’t understand. Jargon also comes over as being pretentious and vague. So work hard to remove it from everything. There are many technical terms in pensions but try to avoid them. As a last resort, if you do use it, include a jargon buster.

Acronyms tend to be shortened versions of jargon – or another form of jargon. So ask yourself if you need to use them. Make a list of the terms like Lifetime Allowance and the Pension Regulator and decide whether the reader will really understand an acronym. Remember that a communication full of AA, LTA, TPR, DC, IFA, might seem easy to understand to you – but is unlikely to work for your audience.

We can help. Get in touch to kick off your tone of voice workshop.

Behavioural Economics

If we’re communicating pensions, we cannot ignore behavioural economics. Behavioural economics explores why people sometimes make irrational decisions, and why and how their behaviour does not follow the predictions of economic models.

There are many research pieces out there in the pension industry to help us get a very deep understanding of how people work when it comes to making financial decisions. So much so, we’ve lost sight of the theory behind it.

MINDSPACE

MINDSPACE is a very useful way to remember nine of the key behavioural aspects that affect decision making.

Messenger

We are heavily influenced by who communicates to us

Incentives

Our responses to incentives are shaped by predictable mental shortcuts such as avoiding losses

Norms

We are strongly influenced by what others do

Defaults

We go with the flow of pre-set options

Salience

We are drawn to the novel and what seems relevant to us

Priming

Our acts are often influenced by sub-conscious cues

Affect

Our emotional associations can powerfully shape our actions

Commitment

We seek to be consistent with our public promises and reciprocal acts

Ego

We act in ways that make us feel better about ourselves.

Putting it into practice

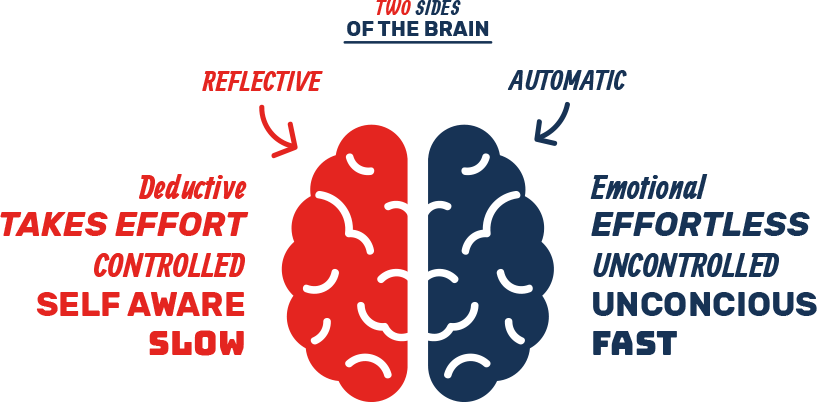

To put all of this into practice it is useful to understand how our brains work and how that causes people to act irrationally and inconsistently. Unfortunately we presume that if we give people information about pensions they will read it and digest and take rationale actions. This is not happening because our minds actually have two systems:

1. The reflective part, which has limited capacity but offers more systematic and ‘deeper’ analysis. This is the ‘slower’ thinking part of the brain.

2. The automatic part. This processes many things separately, simultaneously, and often unconsciously. It takes shortcuts and has ingrained biases. This is the fast part of the brain.

The automatic part of the brain is the part we need to focus on when thinking about language, tone of voice and behaviours. This natural behaviour is the one we need to connect with. It is the part of the brain that makes us buy a coffee and a muffin every morning, rather than thinking about saving £5 a day and putting it into a pension.

Insights from our research

Many respondents have spent time defining a tone of voice for pension communications which is good news. Relatively few use a defined language library.

@yourlandscape

@yourlandscape