Chapter 2

Strategy & Objectives

It will take a range of media and channels, a number of different campaigns and repeated and regular activity. Building engagement and understanding will ultimately give people the confidence they need to take action. Just doing the minimum required by law will not get people in their pension. Promoting the generic benefits of pensions and explaining some of the features of your pensions scheme can help.

Setting your strategic aims

More than ever before, we should be helping people take an interest in their pension savings. Simply meeting disclosure requirements and providing information is not going to bring about a change in how people save. When considering your communication strategy or campaign, it’s worth taking time to understand your current communication approach.

Pension communication

DISCLOSURE vs ENGAGEMENT

Disclosure

Receiver effort rating:

HARD

- Legislation driven

- Compliance to minimum requirements

- Generic information

- Provision of standard communications

- No targeting or segmentation

- Standard tools likely to be available

Promotion

Receiver effort rating:

MODERATE

- On top of legal/compliance information

- A campaign to create action (eg contributions)

- Branded (company or pension)

- Limited segmentation and targeting

- Good range of simple tools likely

- Might be considering targeting by contribution level or age

Engagement

Receiver effort rating:

EASY

- Builds on promotion approach

- Personalised, segmented and targeted communications

- Provides range of media to suit different styles

- Focus on outcomes for individuals

- Delivers a customer journey with consumer grade tools

- Focus on age, pot size, pension goal/outcome for the individual

- Provides some level of guidance

- Might be linked to corporate financial wellbeing strategies

Engagement is created over time. It will take a range of media and channels, a number of different campaigns and repeated and regular activity. Building engagement and understanding will ultimately give people the confidence they need to take action. Just doing the minimum required by law will not get people in their pension. Promoting the generic benefits of pensions and explaining some of the features of your pensions scheme can help.

Strategy and objectives – initial steps

1. Creating a need – what is the ‘problem’ you are trying to solve for the customer?

It’s all too easy to assume that everyone knows they need to save for their future, and assume that they are consciously ‘putting it off’. This might be true for some, but not for all. For some it might be better to focus on what they might be losing out on – for example employer contributions, while for others it might be better to focus on the benefits of starting saving earlier or later. A clear focus on the problem you are trying to solve for the customer will help you create a strong campaign.

2. What is the journey we want people to go on? For example how do we get people to ‘want to save’?

Once we have defined the specific problem, it’s then worth thinking about journey from inaction to action we want to initiate. This example sets out the high level journey from a member’s perspective.

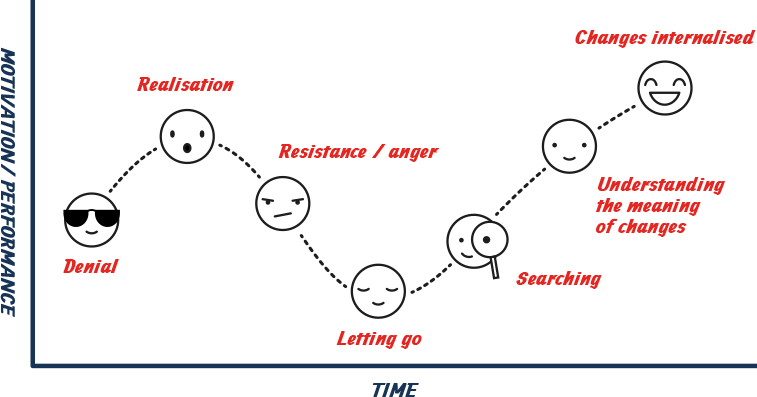

The change curve

Unfortunately initiating change will ‘wake up’ our customer to the problem. Assuming that many of our employees and members are ‘in denial’ about the state of their pension savings is likely to create an emotional reaction. The Kubler-Ross change curve below summarises this journey from denial to acceptance very simply.

Engagement won’t happen overnight

Engagement takes time. Most successful engagement strategies think big but start small. Taking three years to five years to build the right communication tools and channels is not uncommon. However, five years could make a big difference to someone who is mid-career or approaching retirement. Taking time to ensure that each age group receives the right messages at the right time takes careful planning and customer segmentation to avoid ‘communication overload’.

How good are your objectives?

Objectives are your battle-plan. There is a tendency to set high-level, non-specific goals when it comes to pensions. This is a mistake if you want your customer to fully engage and act on the need to save for life after work. So you need to make your pension objectives SMART.

Here’s some questions to prompt SMART Strategy and Objectives:

- 1. How many members are in your selected age cohorts?

- 2. How long have they been saving in the scheme and how have their savings and investments changed?

- 3. What can you determine from their decisions so far? Are they starting out in their work journey, mid-career or approaching retirement?

- 4. Have they only contributed at a minimum level?

- 5. What are the current pot sizes and projected pot sizes and how does this relate to their current salary? What are the groups or profiles most ‘at risk’?

- 6. Are they paying additional contributions (or have they done so in the past), or not?

- 7. Are they in the default investment option, or have they actively made investment decisions?

- 8. Have they completed nomination forms? When were they last updated?

- 9. How often and when do members call the helpline or use online tools?

- 10. Are there internal or external factors which trigger helpline calls and online activity?

- 11. How many attend webinars, surgeries, roadshows and presentations about their pension?

- 12. How many emails do your members open? How many are deleted, without opening?

- 13. What times of the day are emails opened, on what type of devices? How long do people look at the links? Do they access the links at all?

- 14. How long do people view any videos or animations you have communicated on pension? How does that compare with other company communications? Do they drop off before the end? What is this telling you about the communication?

- 15. Have you run a targeted campaign (e.g. for nomination forms or increasing contributions)? What data points did you capture and can you use this as a benchmark for future campaigns?

- 16. Are your other data points trying to tell you something? For example opinion surveys, take up of other benefits (e.g. share schemes, flex, voluntary benefits, etc.)?

Our Findings

The majority of schemes we have spoken to have set a communication Strategy and Objectives. Interestingly our respondents had a very mixed approach to Strategy and Objectives. Key themes such as ‘Informed choices’, ‘providing a range of media’, ‘providing information’ were commonly cited. Sadly, a number of respondents confirmed that although they had some objectives, they were not formally agreed as part of a communication strategy and as such many felt they were only ‘fairly’ effective. Relatively few respondents have set a digital strategy, although many cited that this was something they were planning to do.

Point of view

We need to be set SMART objectives as part of an overarching communication strategy. Those objectives need to be agreed with all stakeholders to ensure a clear understanding and commitment.

@yourlandscape

@yourlandscape