Chapter 7

Going Digital and Social

Long gone are the days when employees would stick with an employer for life, sleeping soundly with the knowledge that they would be able to live comfortably in retirement on the income they accumulated in their defined benefit pensions.

Priorities lay elsewhere when it comes to finances, which is why the pensions industry, employers, and government must do more to make saving for the future the norm. Many people are aware that saving is essential, but more needs to be done collectively to turn that awareness into action and to get them actively doing it to ensure they have an income after their working life.

Employees, particularly millennials, are increasingly in search of an employer that offers corporate values to which they can relate and connect. Those same employers need to work hard to reach these employees in new and engaging ways, and this is where digital and social media enter the pensions communications space.

Former Shadow Minister for Pensions 2011 – 2015

Between June 2015 and 2023 the number of text messages sent worldwide per year grew from 20 billion to 23 billion. The UK is bucking that trend with a steady decline. Although we still send over 99million messages a day, WhatsApp is far more popular with 76% of adults having used it in the last 3 months.

And if those numbers seem particularly shocking, then the numbers attached to the far newer, far scarier digital frontier will truly amaze. Facebook Messenger and WhatsApp combined account for triple the number of text messages sent per day, and increasingly so for work-based, as opposed to personal reasons. As Mary Meeker’s 2016 Internet Trends Report reads: “Messaging is evolving from simple conversations to business conversations.”

Even as far back as 2002, a survey by Boston Consulting Group showed how new media communication methods were taking over from more traditional approaches – with a reduction in the number of face-to-face meetings, and online communities as the fastest-growing new channel.

So yes, in case you missed the update (or memo, text, Facebook message, email, emoji, ping, like, Tweet or IM), digital communication is a huge deal, and it’s not going away. Many of the predictions in the digital realm have come to pass, but the truth is, much of this promise has yet to be realised in the pensions space.

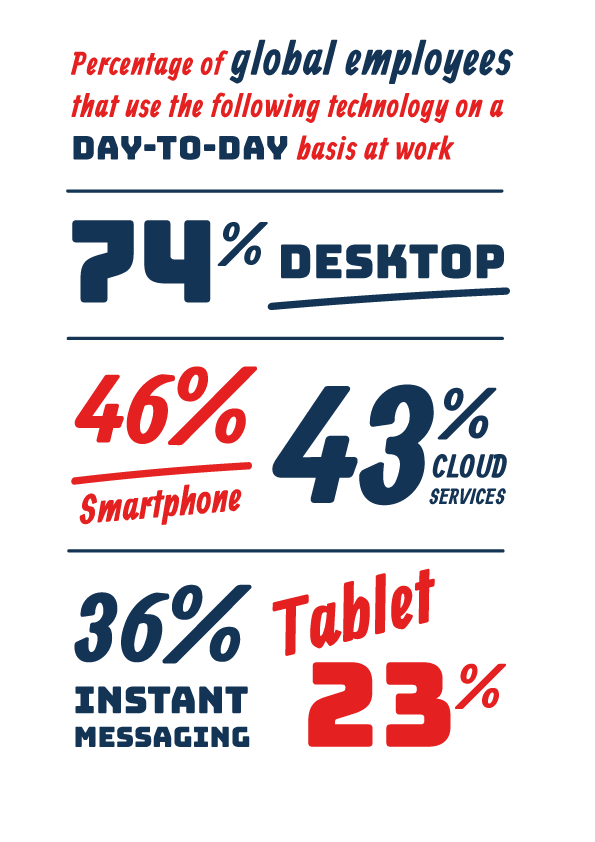

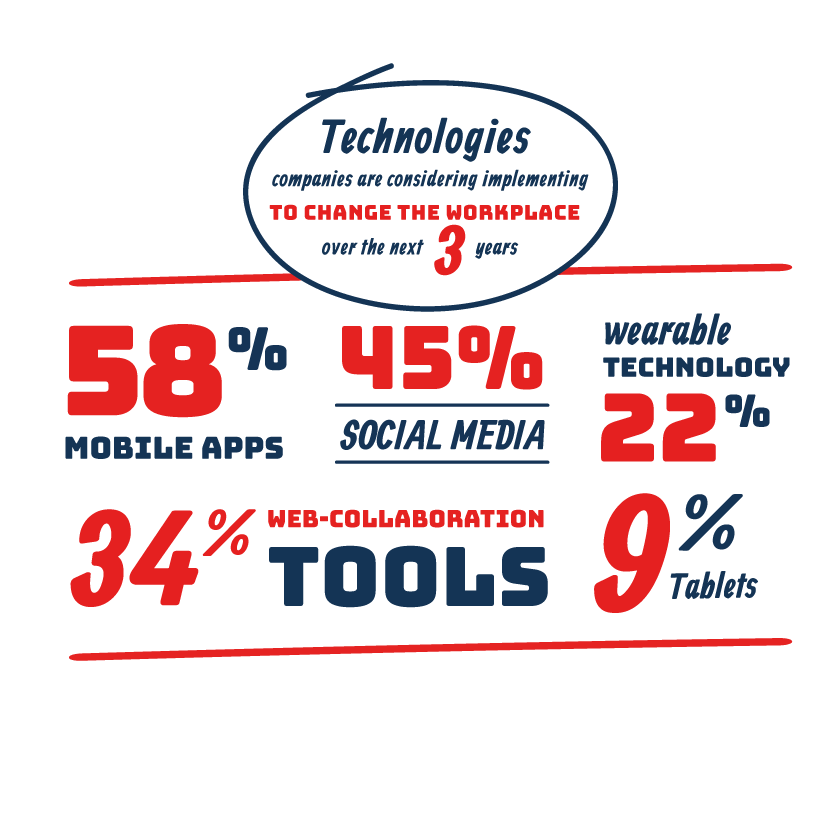

With an increasingly youthful and tech-savvy generation entering the workplace, these methods of communication are frequently embedding themselves into the fabric of our work lives and they ought to be embraced by employers hoping to achieve engagement in pensions. Millenials in particular, are increasingly in search of employers with corporate values to which they can relate and connect. Pensions and savings related benefits are probably not on their list but they should be. Reaching employees as they start their working life could help embed positive financial decision-making for the remainder of their working lives.

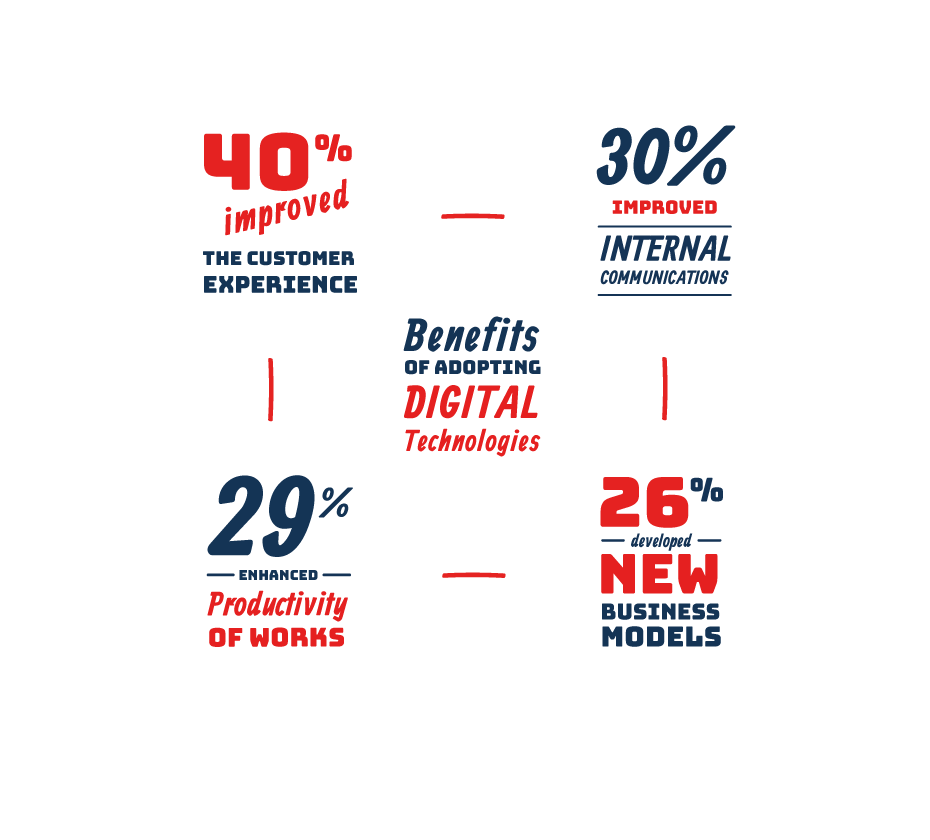

Digital and social media are a powerful set of tools, but they’re not a panacea. If you haven’t got a pension engagement/communication strategy in place, it does not matter if what you do is online or offline, paper or iPad. To successfully implement tools you need to carefully craft implementation plans, and not assume that a new technology is a cure-all.

Our Findings

A majority of organisations we spoke to noted that they have completed or are about to embark on creating a digital communication strategy.

8 Digital Ideas for Pensions Engagement

Create a series of videos covering hot topics relevant to your membership.

Build in social interactivity to enable comments, sharing, and liking. Members and users creating this dialogue should spread your pension content even further, reaching the hardest to engage.

Deploy a digital clock that counts off the paydays left before a savers expected retirement date.

Create a pension game or quiz and make saving more fun.

Digital tools can provide live metrics and to help create and enhance future communications.

You might think that emojis are inappropriate for pensions, but the fact is, emojis are quickly and widely understood, they cross language barriers, they suggest familiarity and friendliness.

Create a scrolling digital story for the personas and segments you’ve identified in your data.

Give savers a digital decision-maker to help them determine their saving and spending preferences.

@yourlandscape

@yourlandscape