Chapter 3

Understanding your audience

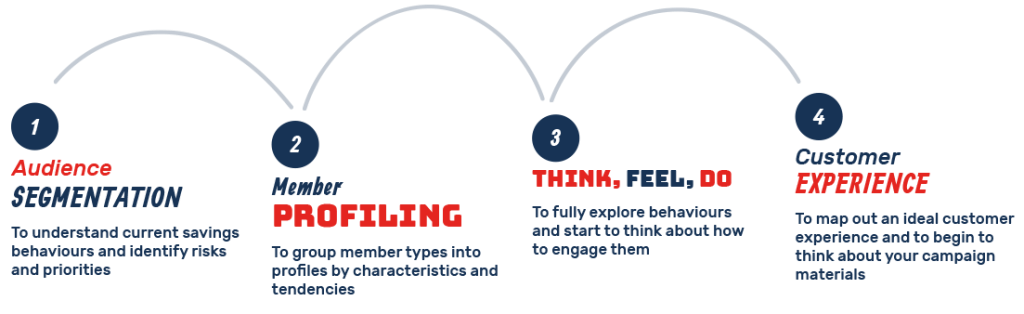

Understanding your audience and what makes them tick takes time and thought. The following four methods can help you better understand your customer and help you create a better campaign or communication strategy. Just using one or two could make a significant difference to how and what you communicate.

Audience segmentation

Segmentation is the process of grouping members or employees according to a range of variables, (for example by age, salary, etc.) which determine their characteristics and tendencies. Once our customer is segmented, we can think about targeting messages to those different groups and what we want them to do.

The first step in this journey is to look in detail at your member data. Ideally, your administration system will be able to provide you with outputs similar to the simplified example below. Creating targeted messages for people most ‘at risk’ in your data is far easier when you have a detailed understanding of their profiles and characteristics.

Member profiling

Having segmented your audience data, you can now identify specific groups for targeting. The data segmentation exercise will provide detailed insights into the particular ‘hot spots’ within your membership. The following chart shows typical member profiles by age and examples of high-level messages.

Your data analysis from your Strategy and Objectives will help you determine seven key areas:

Key message:

Are you contributing as much as you can and planning to step up your contributions over time?

Think about:

What other savings and financial pressures do you have? Starting earlier makes a big difference. Don’t leave it too late.

Understand:

How much you think you will need to maintain your lifestyle for life after work.

Key message:

What will your future look like? How wide is the gap in your savings and your plans?

Think about:

Do you need to do more now, before it’s too late? How well are your investments doing? Have you got a goal or target in mind?

Understand:

The flexibility and choices you have available to save for life after work.

Key message:

What are your ambitions for later life? Are you progressing towards your goals?

Think about:

Have you investigated your options in more detail? It’s time to get financial advice and work out a plan for the future.

Understand:

The options you will have and how to fund your future life.

Seeing the bigger picture

Segmenting the data will give one perspective. But it doesn’t give the full picture. For example, we’re ignoring here what motivates people and their personal preferences and traits. Obtaining feedback from real people who fit generic profiles, for instance, will give you greater insight into how to engage them, what channels to use and why they do or don’t do something.

Is it that simple? Of course, we know it isn’t. It’s more common for people to have many pensions with multiple employers and in some cases multiple pensions with the same employer. Using a segmented approach and pushing the boundaries a little for your providers and advisors is needed.

The best example of a segmented communication is a personalised newsletter. These can be produced by various mailer software, such as Mailchimp, Dotmailer and others, or developed directly from an administration system.

Think, feel, do

Think, feel and do is a simple before and after exercise that explores current thinking and behaviour. It begins the process of identifying the way to engage member profiles or types. It helps by putting you ‘in the shoes’ of the person with whom you want to engage. Having identified your member profiles and hot spots you can use this brainstorm approach to obtain a shared view of the challenges of engaging these different groups. Here’s an example based on the above member groups identified.

Completing a ‘Think, Feel, Do’ for each core profile might seem overkill, but it will help with determining priorities for budget purposes, communication channels and media, as well as engaging your people creatively.

Building a Customer or Consumer experience

Customer experience doesn’t have to mean an Amazon retail account, although that type of easy-to-navigate customer journey should be the aim. Whether it’s creating an online or multi-media experience, using a simple timeline can help give you a clear view of the customer journey and help to make it a good one. This might be an annual experience, for a particular campaign or customer.

Our Findings

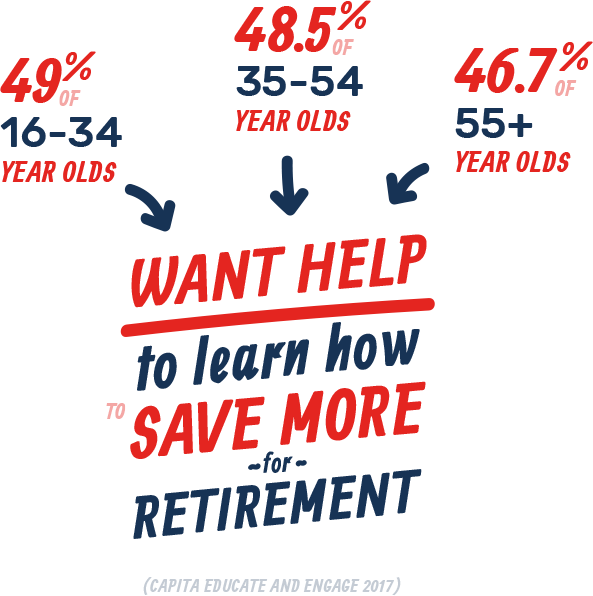

Our research has shown that segmentation is becoming a key tactic in communication planning and strategy. It’s growing in sophistication, many are not adopting this approach. The majority is segmenting communication by scheme type, and there is growing focus on age, investment type, contribution level and salary. Very few in the DC world appear to be focusing on the value of a member’s savings pot.

Point of view:

Segmentation is critical to member engagement. Personalised communications are the most effective and segmentation can be almost as effective if done well. To truly engage savers we need to create an emotional connection and show them we understand what it means to them. Segmentation is essential.

@yourlandscape

@yourlandscape